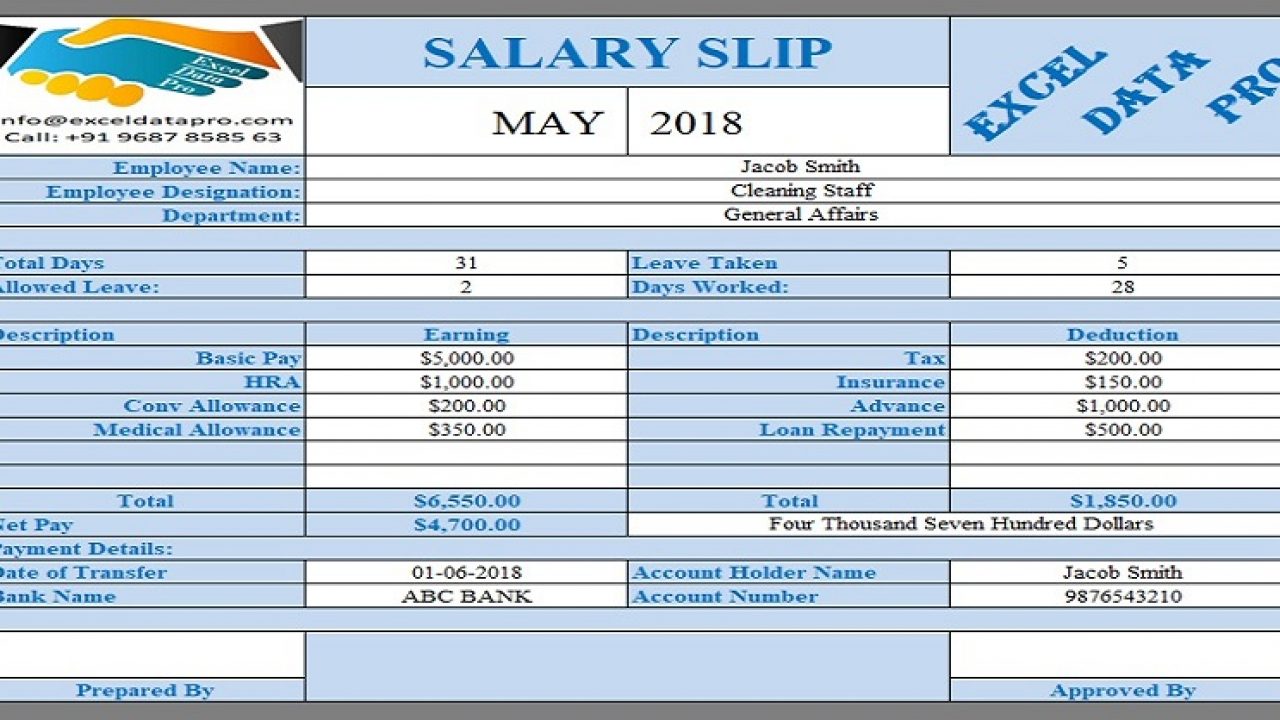

And components of your salary are present on salary slips, so you can reference salary slips when filing income tax returns. Moreover, lenders and credit card companies can assess your creditworthiness from the previous three to six months based on salary slips. Salary slips can help in negotiation processes so that you can get a higher position and compensation based on your current designation and salary. They serve as income proof when applying for work permits and aid your job search. They are proof of your wage, and new employers, banks, credit card companies, and income tax departments often ask for them. Salary slips are required for a variety of reasons. Other segments showcased are the items deducted from your paycheck (provident fund-PF, professional tax, and tax deducted at source-TDS). Salary slips contain various elements of your wage such as the basic salary, house rent allowance (HRA), dearness allowance (DA), and performance-based incentives. This includes deductions and your take-home salary.

What is a Salary Slip?Ī salary slip is a formal document employers give you every month to inform you of the details of your pay package. Salary slips also contain basic information such as company name, employee name, designation, and employee code. Understand the percentage of the salary that is forced savings.

0 kommentar(er)

0 kommentar(er)